First-home buyers get some help State and federal governments are creating new incentives to help first-home buyers get into the overheated housing market. Buying your own home is the largest purchase decision most people will make in their lives. However, a...

Latest News / Blog Post

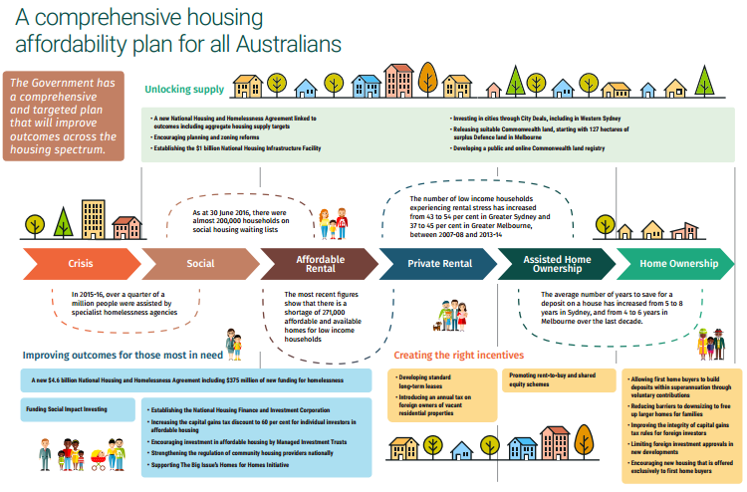

Budget 2017: Housing Affordability

The Government has announced some Incentives to improve housing options. Among these, are: Allowing first-home buyers to save a deposit through voluntary contributions to superannuation Disallowing travel deductions for investment residential property Limiting...

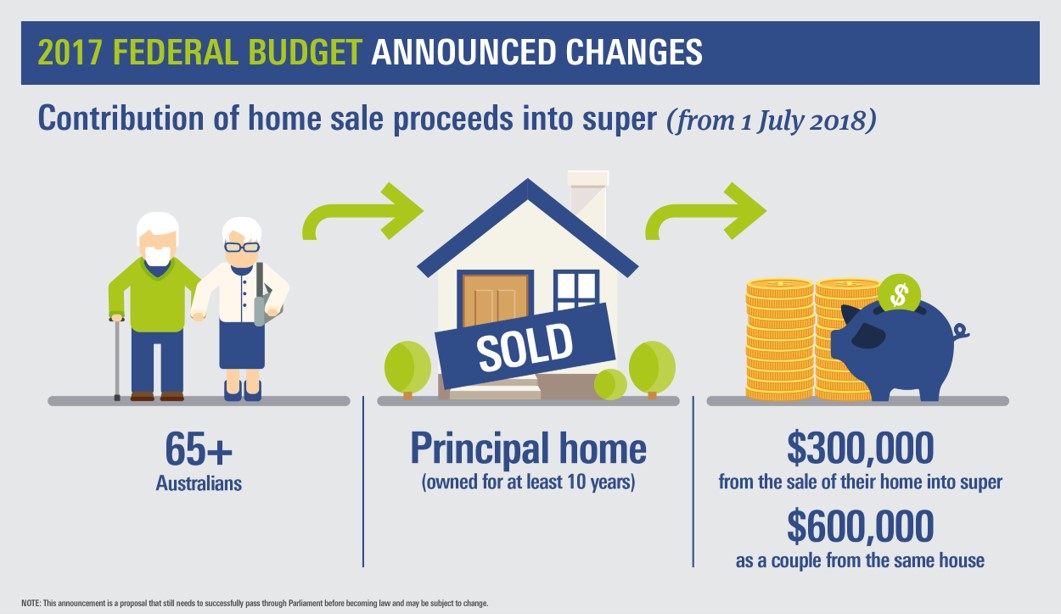

Need to Understand a little more about the Downsizing Contribution?

As you're not doubt aware, the Federal Government announced it's 2017 Budget this week and one of the surprise outcomes was the Downsizing Contribution for those looking to move out of a larger family home. Here's a little more about how that works... Downsizing...

Government Entitlements for Retirees

The Government has legislated changes to the Age Pension rules from 1 January 2017, which it estimates will see 300,000 Australians lose all or part of their pension entitlements.1 If you are retired or about to retire, some careful planning now may put you in shape...

Retirees and Life Insurance

You’re retired, the house is paid off and the children are self-sufficient, – it may be time to review your life insurance? Policies expire People take out life insurance while they are working to protect their dependants if they die prematurely. Life insurance...

Significant changes to contribution limits to super could prove a challenge

The changes to super and tax laws proposed in this year’s federal budget, then revised and adjusted by the government in September, have been passed through Parliament and are mostly due to take effect from July 1, 2017. That means that you have until July to consider...

Property and super – beware the pitfalls

Recent years have seen a rush of investors buying property through super. But while the strategy has its advantages, there are also some potential risks to be aware of. The pitfalls While property has been a good performer in recent years, property investing still...

Government releases more superannuation legislation

On 27 September 2016 the Government released another round of draft legislation implementing a number of the changes to superannuation it announced in the 2016 Federal Budget. Many of these changes will apply from 1 July 2017 so it might be sensible to for you to...

Four common mistakes when buying insurance

If your life insurance policy is in a drawer gathering dust, your family could be in for a nasty shock in the event of a claim. Here we outline some pitfalls to avoid when taking out cover. 1. Buying on price rather than cover No-one wants to pay too much for...

2016 Federal Budget Analysis

Treasurer Scott Morrison has handed down his first Federal Budget - the Coalition Government’s third. The winners are low and middle income earners, unemployed youth and small business, and there are significant changes to superannuation. Note: These changes are...

RECENT POSTS

CATEGORIES

Head Office

P.O Box 3592, Burleigh Town, QLD, 4220

Contact Us

Phone: 07 5593 0855

Email: info@wealthplanningpartners.com.au

Office Hours:

9am - 5pm Monday to Thursday

9am - 12pm Friday

(Other appointment times by request)

Registration

WPP Licensee Services Pty Ltd

P.O Box 3592, Burleigh Town, QLD, 4220

Robina, QLD, 4226

AFSL No. 530393

ABN# 76 649 079 998

Copyright © 2023 Wealth Planning Partners Pty Ltd | All Rights Reserved | Website designed by Xenex Media