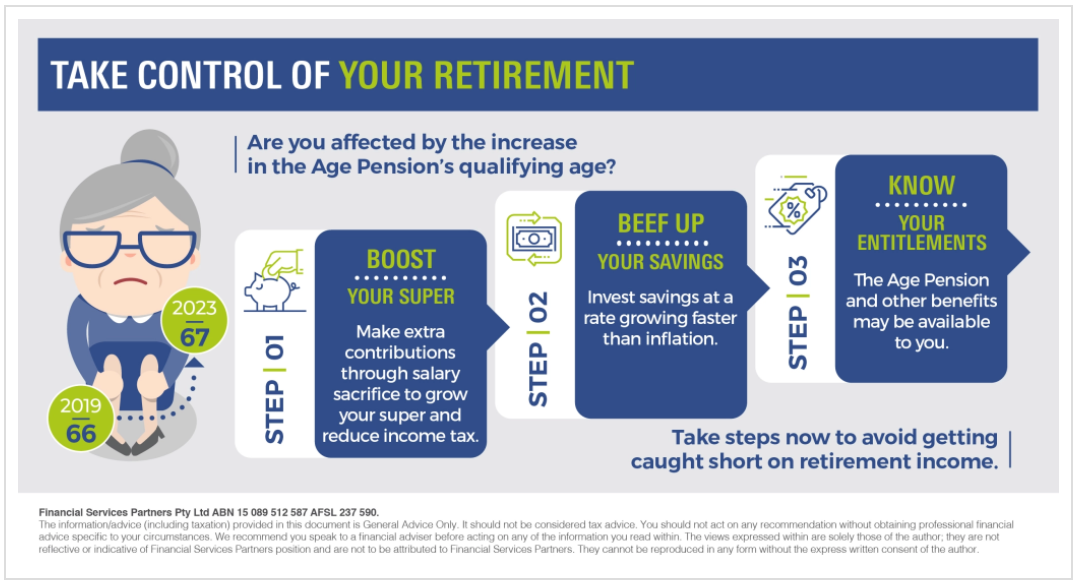

Are you approaching retirement? Chances are the funding of your lifestyle in retirement may be on your mind! Take steps now to avoid getting caught short on retirement income and live the retirement lifestyle you want. It's time to take control of your retirement....