As a result of all the global economic changes from the COVID pandemic, many have started their own business to generate income. With this global shift, people have figured out new ways to be their own boss, in turn, gaining more...

As a result of all the global economic changes from the COVID pandemic, many have started their own business to generate income. With this global shift, people have figured out new ways to be their own boss, in turn, gaining more...

Get ready for storm season! The Queensland Government want everyone to Get Ready for disaster season. Use the 3 Step "Get Ready" Plan. Prepare your household this storm season by completing these 3 simple steps: Have a plan Firstly, ensure your family is equipped...

Starting a new business can be exciting but there’s a lot to think about and organise too. Before you even begin, consider how prepared you are to make the difficult decisions, work those long hours required, face possible and ongoing financial constraints, lose a...

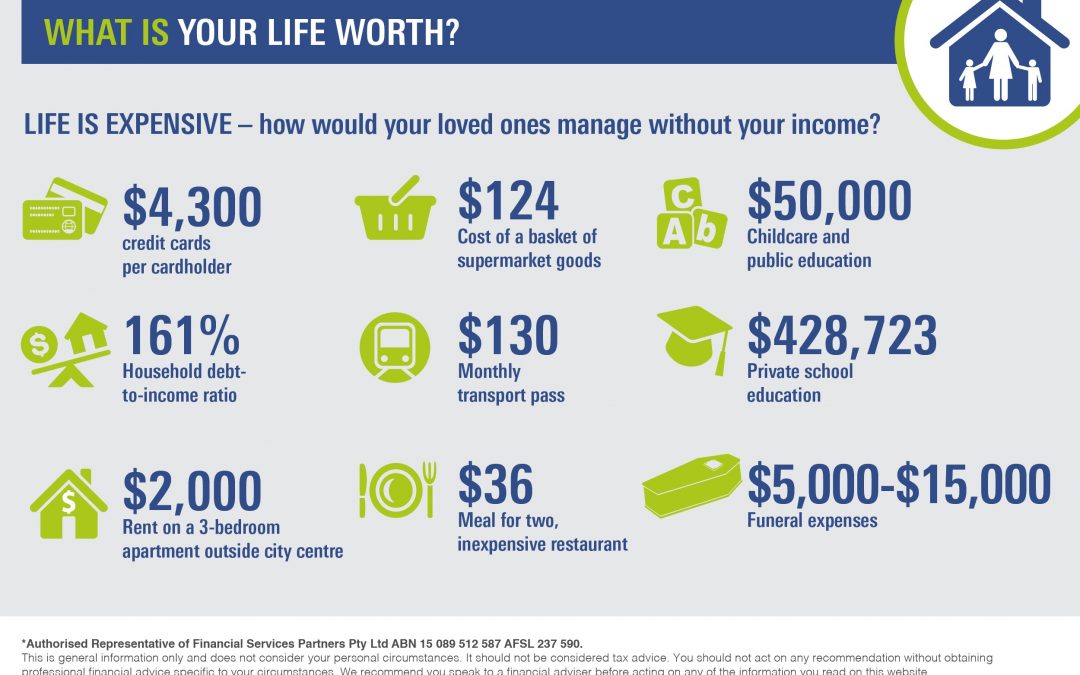

How would your organisation cope if something happened to a key person? Unexpected events can play havoc not only with people’s lives but also with businesses. However, business owners are often so busy they don’t stop to consider the true cost of the loss of a key...

You’re retired, the house is paid off and the children are self-sufficient, – it may be time to review your life insurance? Policies expire People take out life insurance while they are working to protect their dependants if they die prematurely. Life insurance...

From wills to long-term budgeting, there’s a lot to think about when making your retirement to-do list. Here’s some top tips to make sure you’ve ticked all the boxes. 1. Check your Will and Power of Attorney documents Without a valid will, an administrator will be...

Protecting yourself from frivolous creditors and lawsuits is becoming an increasingly common concern. Here we outline some of the ways you can insulate your assets. Check your insurances Liability insurance is a must if you want to safeguard your assets in the event...

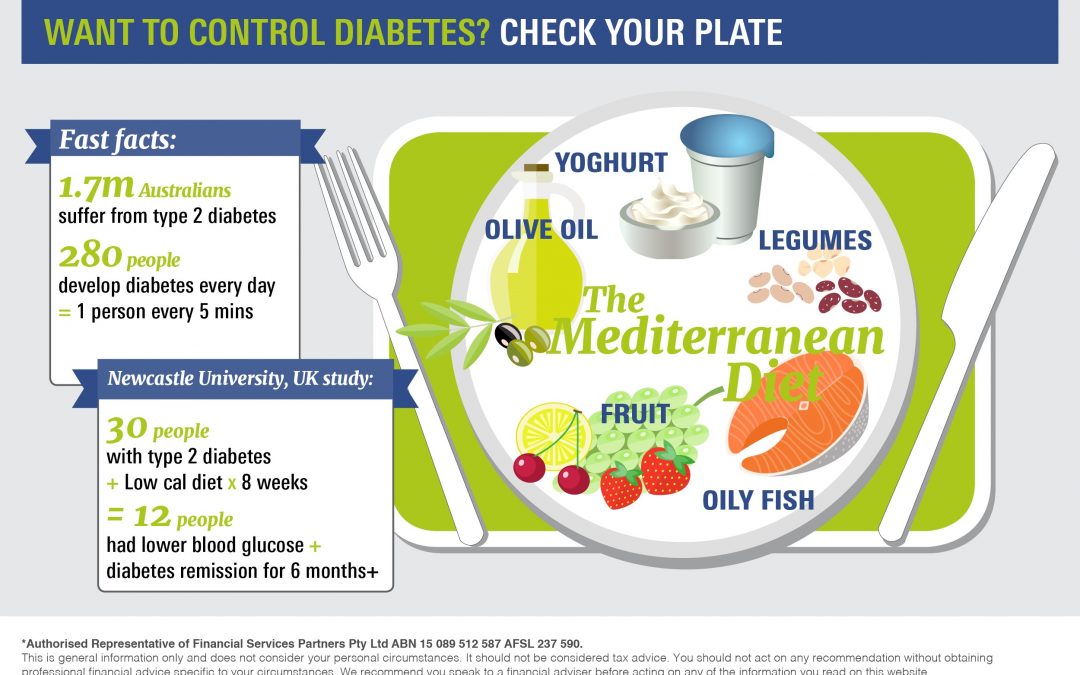

What if you could reverse diabetes with chickpeas, fish and olive oil? A new study from Newcastle University links a very-low-calorie diet with the cessation of type 2 diabetes. Type 2 diabetes is a progressive condition, at first managed by diet or surgery, and then...

If your life insurance policy is in a drawer gathering dust, your family could be in for a nasty shock in the event of a claim. Here we outline some pitfalls to avoid when taking out cover. 1. Buying on price rather than cover No-one wants to pay too much for...

With the majority of Australians still dangerously underinsured, is it time you reviewed your cover? Jeff is a clean-living 53-year-old who exercises regularly, doesn’t smoke, enjoys a healthy diet and only indulges his love of good wine at the weekend. Yet things...

RECENT POSTS

CATEGORIES

P.O Box 3592, Burleigh Town, QLD, 4220

Phone: 07 5593 0855

Email: info@wealthplanningpartners.com.au

9am - 5pm Monday to Thursday

9am - 12pm Friday

(Other appointment times by request)

WPP Licensee Services Pty Ltd

P.O Box 3592, Burleigh Town, QLD, 4220

Robina, QLD, 4226

AFSL No. 530393

ABN# 76 649 079 998

Copyright © 2023 Wealth Planning Partners Pty Ltd | All Rights Reserved | Website designed by Xenex Media