News / Articles

-

#Economy | Posted On : Apr 20, 2018

Diversification of assets is a good defence against a fall

Increased Diversification can assist in lowering risk in times of market volatility. A properly constructed portfolio can protect investors in downturns in the market and help provide appropriate returns at other times. Portfolios which include diversifying assets may protect the overall portfolio against equity market volatility. It’s been over ten years now since the last […]

-

#Budget | Posted On : Apr 9, 2018

A money-wise wedding: Creating a budget for the big day

Whether you’re planning a large, luxurious wedding or a small, intimate affair, smart budgeting could help free you from financial worries, so you can enjoy your special day. Following these steps may help ensure no one’s worried about debt on the honeymoon. 1. Plan early Given that the average Australian wedding costs $36,200[1], the sooner […]

-

#Budget | Posted On : Feb 12, 2018

Create a great financial new year

New Year’s resolutions are easy to make but often hard to keep. But there are real benefits to making financial resolutions. Here are some helpful suggestions to get you started. Get back to basics If you find it near-impossible to reach your financial goals, you may need to revisit the basics: sticking to a budget. […]

-

#Budget | Posted On : Jan 15, 2018

Planning a holiday? Here are some tips!!

With the summer holidays right on top of us, it’s not too late to do your financial planning for the holidays – or start planning for later in the year. Here’s how to minimise your financial stress for a well-deserved break. Plan ahead The earlier you start planning, the more money you can save. And […]

-

#Finances | Posted On : Dec 12, 2017

Same-sex Marriage triggers Estate Planning challenges

With the recent legalisation of same-sex marriage in Australia, it’s likely we’ll see a slew of marriages in 2018! But, be warned! Same-sex couples are urged to review estate planning documents, as marriage can invalidate a binding nomination… in some cases. While the parties and proposals continue Down Under, same-sex marriage reforms will bring significant […]

-

#In The Media | Posted On : Dec 10, 2017

Cover Story – Amanda Cassar

Power of Social Amanda Cassar Director, Wealth Planning Partners. In 2015, Amanda Cassar travelled to Uganda as part of the Hunger Project. She talks to Jamie Williamson about how the experience shaped her approach to financial advice.

-

#Budget | Posted On : Nov 20, 2017

Budget for a very merry Christmas

A bit of planning and forethought may help take the financial stress out of Christmas. Christmas for many families, is a happy time of year that brings people together, but it can also be expensive! With a bit of early planning you may control your festive season spending. Here are some tips to help avoid […]

-

#Business | Posted On : Nov 13, 2017

Key-person insurance: Protection for your business

How would your organisation cope if something happened to a key person? Unexpected events can play havoc not only with people’s lives but also with businesses. However, business owners are often so busy they don’t stop to consider the true cost of the loss of a key employee, business partner or even themselves. The knock-on […]

-

#Finances | Posted On : Oct 23, 2017

5 Tips on Giving to Charity

Feeling generous and want to make a difference? Here are five tips on giving to consider. An estimated 14.9 million Australian adults (80.8 per cent of the population) gave $12.5 billion to charities and not-for-profit organisations in 2015–16.[1] For many people, donating comes as a response to a specific request, but if you feel strongly […]

-

#General | Posted On : Oct 17, 2017

Reduce stress to cut your heart attack risk

A new study links stress with heart disease, but there are easy ways to stay healthy and protect your heart. Stress is part of modern life but a new study shows that being stressed takes a serious, and lasting, toll on your health and increases your risk of heart disease. The multi-year study published in […]

-

#Budget | Posted On : Sep 18, 2017

Money hacks for teens and young adults

Help your teens and young adults manage how they spend and save. So your teenagers and young adults know how to spend, but do they know how to budget for the things they really want? Learning good money management should be an essential life skill. A reason to save For many teenagers and young adults […]

-

#Finances | Posted On : Aug 21, 2017

A few things have changed in super

Many of the federal government’s superannuation reforms came into effect on 1 July. Here’s what’s new. The government says it has tried to make the superannuation system more sustainable and has introduced more flexibility to suit modern work patterns. This is what has changed. Additional 15 per cent tax for high income earners and concessional […]

-

#General | Posted On : Aug 11, 2017

Fixed Income: Friend or Foe?

Fixed income has been a friend to investors. Over the past 20 years, the annualised return to the end of last year for both domestic and global fixed income has exceeded global share returns. But with rates so low and bond prices so expensive, will fixed income become your foe? Read on to find out […]

-

#Advisers | Posted On : Jul 3, 2017

First Home Buyers Assistance

First-home buyers get some help State and federal governments are creating new incentives to help first-home buyers get into the overheated housing market. Buying your own home is the largest purchase decision most people will make in their lives. However, a long run of low interest rates has fuelled spectacular dwelling price growth, record […]

-

#Australian Economy | Posted On : May 12, 2017

Budet 2017: Proposed Tax Measures

Budget 2017 has proposed a few tax changes. Read about them here: Medicare levy Rises from 2.0% to 2.5% from 1 July 2019 to help fund the National Disability Insurance Scheme. Capital gains tax discount for investors in affordable housing Managed investment trusts will be allowed to develop and own affordable housing. Investors will get […]

-

#Finances | Posted On : May 12, 2017

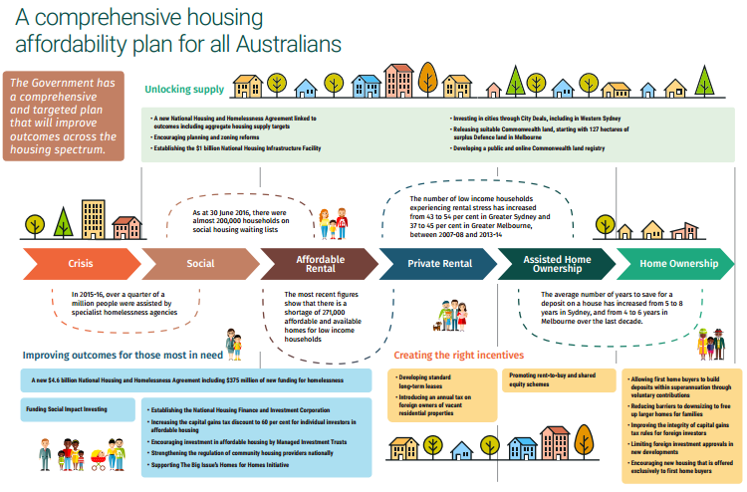

Budget 2017: Housing Affordability

The Government has announced some Incentives to improve housing options. Among these, are: Allowing first-home buyers to save a deposit through voluntary contributions to superannuation Disallowing travel deductions for investment residential property Limiting depreciation deductions for plant and equipment on residential investment properties Tightening the capital gains tax rules for foreign investors Reforming foreign investment […]

-

#Australian Economy | Posted On : May 11, 2017

Budget 2017: Social Security

Lots of Social Security changes have been proposed in Budget 2017. Here’s a highlights list of some of these. Please note that these are not yet enshrined in law. Reinstating the Pensioner Concession Card This will be reinstated for pensioners who lost their pension following changes to the pension asset test on 1 January 2017. […]

-

#Australian Economy | Posted On : May 11, 2017

Budget 2017 – Who are the Winners & Losers?

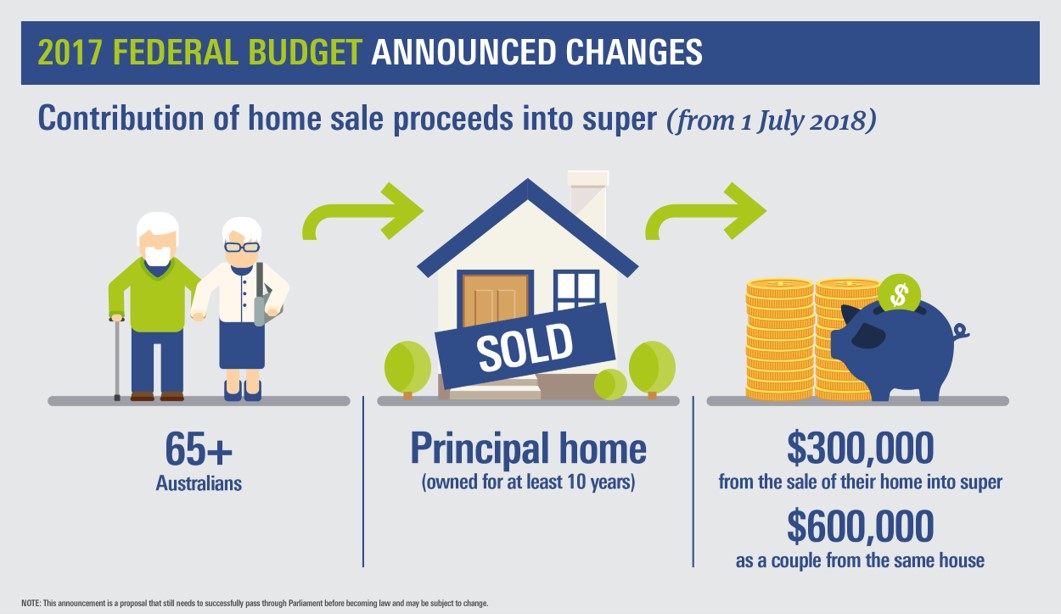

WINNERS!! First home-buyers First home-buyers can save for a deposit by salary sacrificing into their super. Downsizers Downsizers, 65+, can contribute up to $300,000 each to super from the sale the family home regardless of satisfaction of the work test, total super balance or if aged 75 or over. Investors Negative gearing stays for mum […]

-

#Advisers | Posted On : May 11, 2017

Need to Understand a little more about the Downsizing Contribution?

As you’re not doubt aware, the Federal Government announced it’s 2017 Budget this week and one of the surprise outcomes was the Downsizing Contribution for those looking to move out of a larger family home. Here’s a little more about how that works… Downsizing contribution People aged 65 or over will be able to make […]

-

#Budget | Posted On : May 1, 2017

Are You Missing out on Government Entitlements?

The chances are you dutifully file your tax returns every year but are you making the most of your government entitlements? In this article, we guide you through some key entitlements available for families. Are you confused about your government entitlements? The good news is the recent overhaul of the Department of Human services no […]

-

#Budgeting | Posted On : Apr 18, 2017

Safeguarding your retirement plan

From wills to long-term budgeting, there’s a lot to think about when making your retirement to-do list. Here’s some tips to make sure you’ve ticked all the boxes. 1. Check your will Without a valid will, an administrator will be appointed to manage your estate, which may cause your family plenty of problems. To save them […]

-

#Finances | Posted On : Apr 2, 2017

Government Entitlements for Retirees

The Government has legislated changes to the Age Pension rules from 1 January 2017, which it estimates will see 300,000 Australians lose all or part of their pension entitlements.1 If you are retired or about to retire, some careful planning now may put you in shape to access at least a part Age Pension. Here […]

-

#Advisers | Posted On : Mar 16, 2017

Retirees and Life Insurance

You’re retired, the house is paid off and the children are self-sufficient, – it may be time to review your life insurance? Policies expire People take out life insurance while they are working to protect their dependants if they die prematurely. Life insurance policies, including income protection, trauma, and total and permanent disability (TPD) insurance, generally […]

-

#Budgeting | Posted On : Mar 3, 2017

Safeguarding your retirement plan

From wills to long-term budgeting, there’s a lot to think about when making your retirement to-do list. Here’s some top tips to make sure you’ve ticked all the boxes. 1. Check your Will and Power of Attorney documents Without a valid will, an administrator will be appointed to manage your estate, which may cause your family […]

-

#Australian Economy | Posted On : Feb 27, 2017

Significant changes to contribution limits to super could prove a challenge

The changes to super and tax laws proposed in this year’s federal budget, then revised and adjusted by the government in September, have been passed through Parliament and are mostly due to take effect from July 1, 2017. That means that you have until July to consider if there is any action you should take […]

Head Office

P.O Box 3592, Burleigh Town, QLD, 4220

Contact Us

Phone: 07 5593 0855

Email: info@wealthplanningpartners.com.au

Office Hours:

9am - 5pm Monday to Thursday

9am - 12pm Friday

(Other appointment times by request)

Registration

WPP Licensee Services Pty Ltd

P.O Box 3592, Burleigh Town, QLD, 4220

Robina, QLD, 4226

AFSL No. 530393

ABN# 76 649 079 998

Copyright © 2023 Wealth Planning Partners Pty Ltd | All Rights Reserved | Website designed by Xenex Media