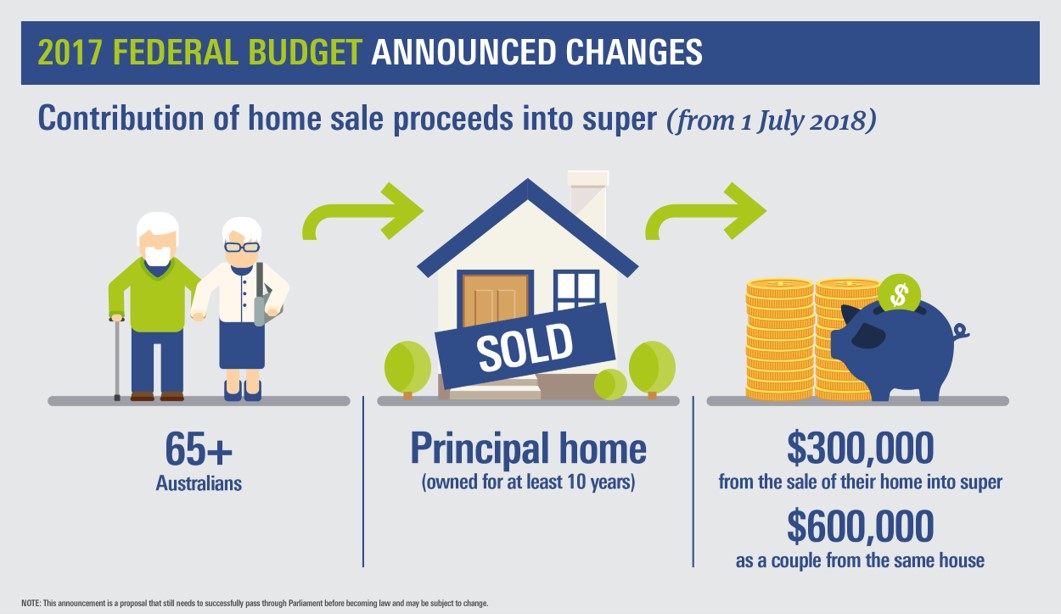

As you’re not doubt aware, the Federal Government announced it’s 2017 Budget this week and one of the surprise outcomes was the Downsizing Contribution for those looking to move out of a larger family home. Here’s a little more about how that works…

Downsizing contribution

People aged 65 or over will be able to make a non-concessional contribution to their superannuation of up to $300,000 each from the proceeds of selling their principal residence.

- Work test does not apply

- Residence must be held for a minimum of 10 years

- Total superannuation balance restrictions of $1,600,000 do not apply

- Restrictions eased on people aged 75 or over.

Downsizing contribution Case Study

John is 75 and Jane is 69 and they both have retirement income streams. They sell the home they have lived in for more than 10 years to downsize and the proceeds are $2,000,000.

George has room under the $1.6 million transfer balance cap. He can make a non-concessional contribution of $300,000 to superannuation and may choose to use the contributed proceeds to start a new account-based pension.

Jane has already used her transfer balance cap. She can make a non-concessional contribution of $300,000 to superannuation. As she has no room under her cap she cannot start a new pension with the contributed proceeds.

It’s worth having a chat with your Adviser to see if this is the best strategy for you, as you may lose Centrelink entitlements, depending on your new circumstances.

January 18, 2025

January 18, 2025