For many years, salary sacrifice has been the most tax-effective way to build superannuation.

Now, youre able to add personal deductible contributions to your super strategy.

For many years, salary sacrifice has been the most tax-effective way to build superannuation.

Now, youre able to add personal deductible contributions to your super strategy.

Increased Diversification can assist in lowering risk in times of market volatility. A properly constructed portfolio can protect investors in downturns in the market and help provide appropriate returns at other times. Portfolios which include diversifying assets may...

Whether you’re planning a large, luxurious wedding or a small, intimate affair, smart budgeting could help free you from financial worries, so you can enjoy your special day. Following these steps may help ensure no one’s worried about debt on the honeymoon. 1. Plan...

A bit of planning and forethought may help take the financial stress out of Christmas. Christmas for many families, is a happy time of year that brings people together, but it can also be expensive! With a bit of early planning you may control your festive season...

Help your teens and young adults manage how they spend and save. So your teenagers and young adults know how to spend, but do they know how to budget for the things they really want? Learning good money management should be an essential life skill. A reason to save...

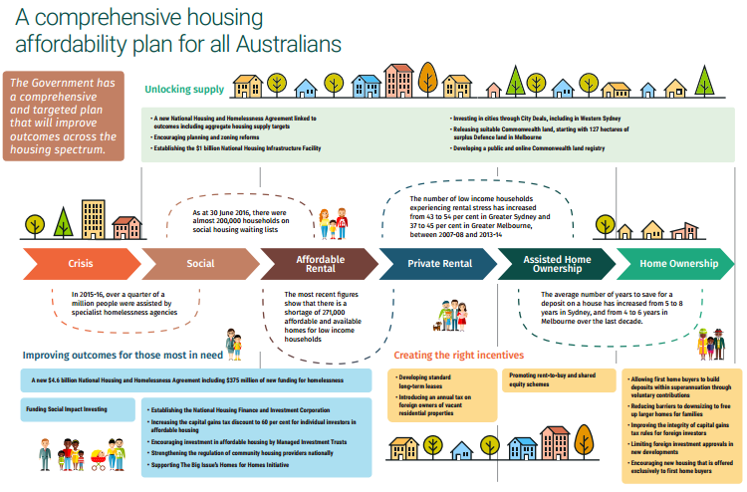

First-home buyers get some help State and federal governments are creating new incentives to help first-home buyers get into the overheated housing market. Buying your own home is the largest purchase decision most people will make in their lives. However, a...

The Government has announced some Incentives to improve housing options. Among these, are: Allowing first-home buyers to save a deposit through voluntary contributions to superannuation Disallowing travel deductions for investment residential property Limiting...

The Government has legislated changes to the Age Pension rules from 1 January 2017, which it estimates will see 300,000 Australians lose all or part of their pension entitlements.1 If you are retired or about to retire, some careful planning now may put you in shape...

From wills to long-term budgeting, there’s a lot to think about when making your retirement to-do list. Here’s some top tips to make sure you’ve ticked all the boxes. 1. Check your Will and Power of Attorney documents Without a valid will, an administrator will be...

Creating a valid will is one of the most important things you can do to protect your loved ones. Here we explain how to go about it. Seek legal advice While DIY will kits can seem like an easy and inexpensive way to make a will, they can be fraught with pitfalls. Your...

RECENT POSTS

CATEGORIES

P.O Box 3592, Burleigh Town, QLD, 4220

Phone: 07 5593 0855

Email: info@wealthplanningpartners.com.au

9am - 5pm Monday to Thursday

9am - 12pm Friday

(Other appointment times by request)

WPP Licensee Services Pty Ltd

P.O Box 3592, Burleigh Town, QLD, 4220

Robina, QLD, 4226

AFSL No. 530393

ABN# 76 649 079 998

Copyright © 2023 Wealth Planning Partners Pty Ltd | All Rights Reserved | Website designed by Xenex Media