Creating a valid will is one of the most important things you can do to protect your loved ones. Here we explain how to go about it. Seek legal advice While DIY will kits can seem like an easy and inexpensive way to make a will, they can be fraught with pitfalls. Your...

Latest News / Blog Post

A guide to charitable donations

When you donate to charity, your gifts may be a tax deductible donation that can boost your tax refund. There are many charities in Australia that rely on donations to continue their good work and nine out of 10 of us give to charity each year*. Here we provide a...

Four common mistakes when buying insurance

If your life insurance policy is in a drawer gathering dust, your family could be in for a nasty shock in the event of a claim. Here we outline some pitfalls to avoid when taking out cover. 1. Buying on price rather than cover No-one wants to pay too much for...

Planning for your retirement: reduce your worries

Planning your finances early means you are better placed to enjoy what really matters in your retirement. Read this guide to find out how. Entering retirement is a significant change – but that doesn’t mean it has to be stressful. By starting to plan early and...

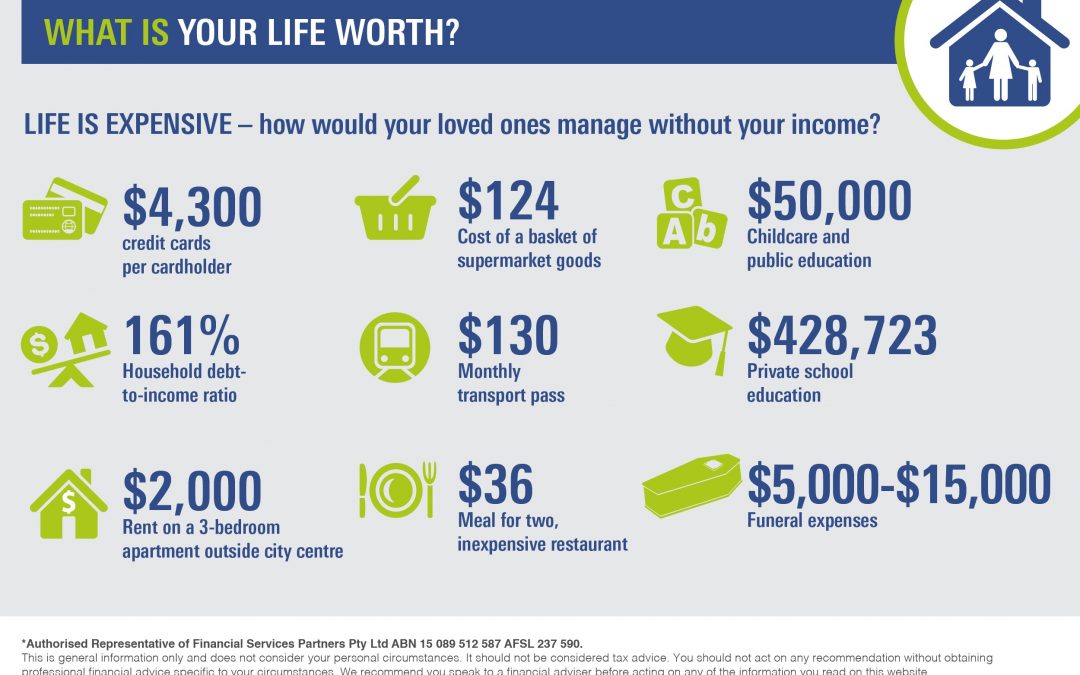

Are you insuring your biggest asset?

With the majority of Australians still dangerously underinsured, is it time you reviewed your cover? Jeff is a clean-living 53-year-old who exercises regularly, doesn’t smoke, enjoys a healthy diet and only indulges his love of good wine at the weekend. Yet things...

Aged Care: the costs, considerations, concerns and what you can do…

Choosing how you age is not just about accommodation for you or your family. There are also a range of financial and emotional issues to plan for. The quality of today’s health care means we are enjoying longer lives, with current life expectancy levels far exceeding...

Putting your Goals First

A goals-based investment approach isn’t focused on ‘beating the market’. It’s about tailoring your investments to meet your personal goals. Performance comparisons are unavoidable in the investment world. Every day you see investment managers measuring their success...

3 Reasons to Bond with Bonds

Bonds are one of the four major assets classes, but they’re probably the least understood. Here’s why they’re an important part of many portfolios. What are bonds? Bonds are essentially loan arrangements that governments and large companies use to raise money. These...

The Big Budget Picture

Tracking where your money actually goes can make revealing reading. ASIC’s 2012 consumer-spending figures show the average household spends $69,000 a year: Australians splash $78.4 billion a year on their cars, compared to just $2.2 billion on public transport; almost...

Accountability and your finances

We all have good intentions when it comes to our wealth. We want to save more, pay down debt, invest well and do better financially... and yet, most of us never meet our wealth or financial goals. Other things easily get in the way of our resolutions and we get to...

RECENT POSTS

CATEGORIES

Head Office

P.O Box 3592, Burleigh Town, QLD, 4220

Contact Us

Phone: 07 5593 0855

Email: info@wealthplanningpartners.com.au

Office Hours:

9am - 5pm Monday to Thursday

9am - 12pm Friday

(Other appointment times by request)

Registration

WPP Licensee Services Pty Ltd

P.O Box 3592, Burleigh Town, QLD, 4220

Robina, QLD, 4226

AFSL No. 530393

ABN# 76 649 079 998

Copyright © 2023 Wealth Planning Partners Pty Ltd | All Rights Reserved | Website designed by Xenex Media