The end of financial year doesn’t have to be too taxing a time. These five tips will help organise your finances for the coming financial year. Take the pain out of EOFY by being organised. With the right preparation, you can make lodging your tax return a painless...

Latest News / Blog Post

Diversification of assets is a good defence against a fall

Increased Diversification can assist in lowering risk in times of market volatility. A properly constructed portfolio can protect investors in downturns in the market and help provide appropriate returns at other times. Portfolios which include diversifying assets may...

Create a great financial new year

New Year’s resolutions are easy to make but often hard to keep. But there are real benefits to making financial resolutions. Here are some helpful suggestions to get you started. Get back to basics If you find it near-impossible to reach your financial goals, you may...

Planning a holiday? Here are some tips!!

With the summer holidays right on top of us, it’s not too late to do your financial planning for the holidays – or start planning for later in the year. Here’s how to minimise your financial stress for a well-deserved break. Plan ahead The earlier you start planning,...

Same-sex Marriage triggers Estate Planning challenges

With the recent legalisation of same-sex marriage in Australia, it’s likely we’ll see a slew of marriages in 2018! But, be warned! Same-sex couples are urged to review estate planning documents, as marriage can invalidate a binding nomination… in some cases. While...

5 Tips on Giving to Charity

Feeling generous and want to make a difference? Here are five tips on giving to consider. An estimated 14.9 million Australian adults (80.8 per cent of the population) gave $12.5 billion to charities and not-for-profit organisations in 2015–16.[1] For many people,...

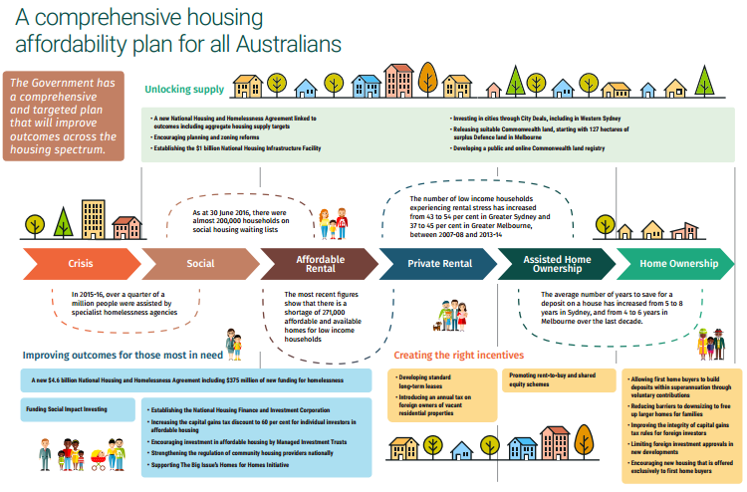

Budget 2017: Housing Affordability

The Government has announced some Incentives to improve housing options. Among these, are: Allowing first-home buyers to save a deposit through voluntary contributions to superannuation Disallowing travel deductions for investment residential property Limiting...

Budget 2017: Social Security

Lots of Social Security changes have been proposed in Budget 2017. Here's a highlights list of some of these. Please note that these are not yet enshrined in law. Reinstating the Pensioner Concession Card This will be reinstated for pensioners who lost their pension...

Budget 2017 – Who are the Winners & Losers?

WINNERS!! First home-buyers First home-buyers can save for a deposit by salary sacrificing into their super. Downsizers Downsizers, 65+, can contribute up to $300,000 each to super from the sale the family home regardless of satisfaction of the work test, total super...

Safeguarding your retirement plan

From wills to long-term budgeting, there’s a lot to think about when making your retirement to-do list. Here’s some tips to make sure you’ve ticked all the boxes. 1. Check your will Without a valid will, an administrator will be appointed to manage your estate,...

RECENT POSTS

CATEGORIES

Head Office

P.O Box 3592, Burleigh Town, QLD, 4220

Contact Us

Phone: 07 5593 0855

Email: info@wealthplanningpartners.com.au

Office Hours:

9am - 5pm Monday to Thursday

9am - 12pm Friday

(Other appointment times by request)

Registration

WPP Licensee Services Pty Ltd

P.O Box 3592, Burleigh Town, QLD, 4220

Robina, QLD, 4226

AFSL No. 530393

ABN# 76 649 079 998

Copyright © 2023 Wealth Planning Partners Pty Ltd | All Rights Reserved | Website designed by Xenex Media