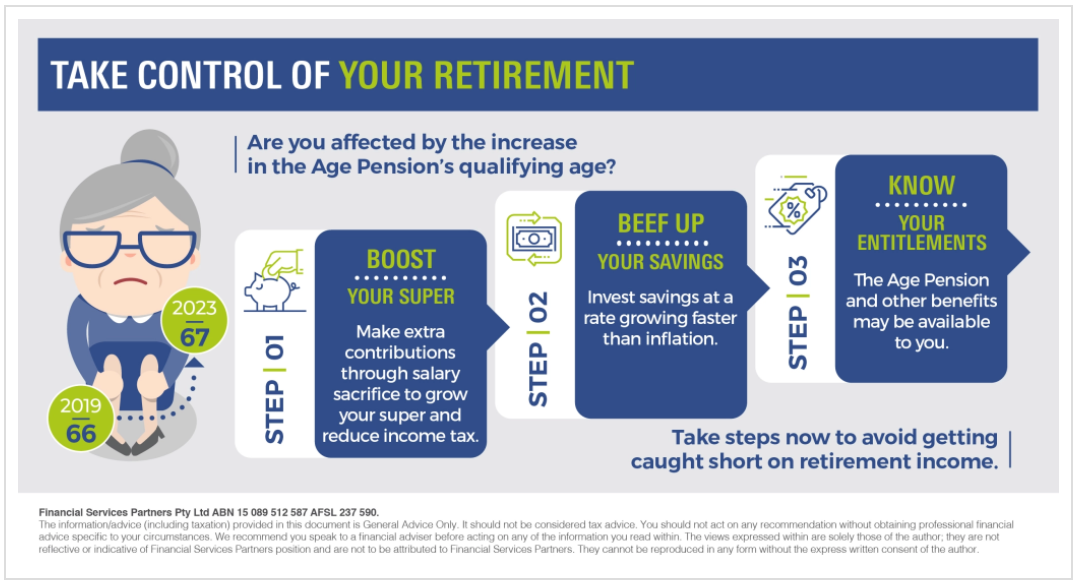

Are you affected by the increase in the Age Pension’s qualifying age? Take steps now to avoid getting caught short on retirement income. The minimum age to qualify for the Age Pension has started going up. For those born on or after 1 July 1952, the qualifying age...