As a result of all the global economic changes from the COVID pandemic, many have started their own business to generate income. With this global shift, people have figured out new ways to be their own boss, in turn, gaining more...

As a result of all the global economic changes from the COVID pandemic, many have started their own business to generate income. With this global shift, people have figured out new ways to be their own boss, in turn, gaining more...

What is ‘Tenancy In Common' 1. "Tenancy in common" allows two or more people to be owners in a property. Each owner has the authority to will their share to anyone on death. 2. "Tenancy in common" is different as the transfer of the property in the event of death...

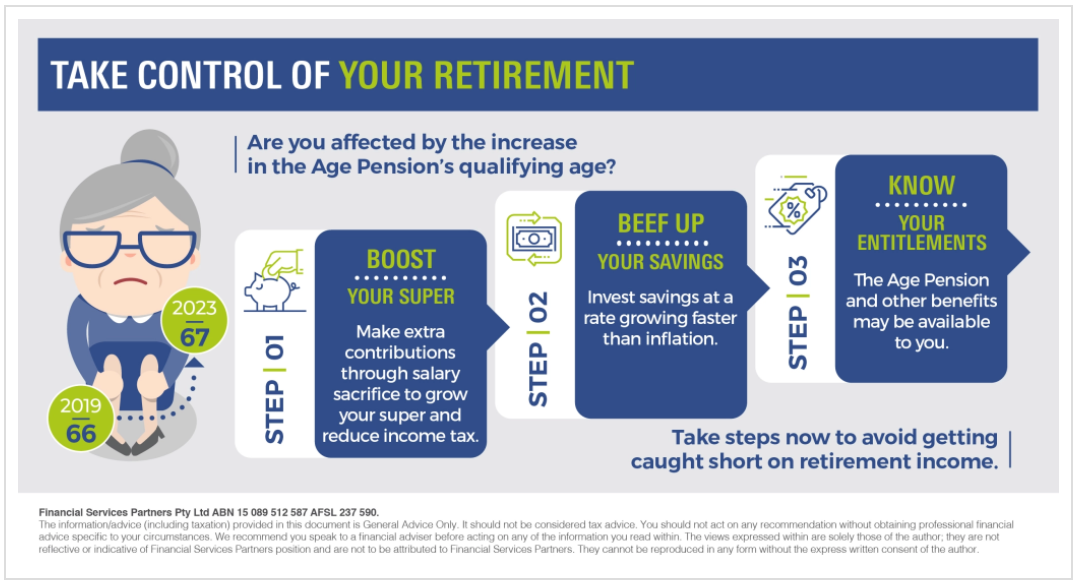

Are you affected by the increase in the Age Pension’s qualifying age? Take steps now to avoid getting caught short on retirement income. The minimum age to qualify for the Age Pension has started going up. For those born on or after 1 July 1952, the qualifying age...

So, how do you invest your money? When deciding how to go about investing those hard earned dollars, you need to decide whether you'll: do it yourself, or pay a financial advisor to do it for you Both options have their pros and cons. However, you can - of course, do...

Is it time to consider your retirement lifestyle needs? Considering the cost of living and your expected annual retirement income, is crucial to retirement planning. So, how do you consider your retirement needs? For the record number of Australians transitioning...

Do you know how to protect yourself against scams? The onset of COVID has propelled social media and marketing to an all-time necessity and has resulted in increased predatory scams and virtual hacking, putting people at risk more than ever before. Here are some...

The ongoing COVID situation means changes to how we do business. If you are not able to visit us in person, or it is more convenient to work with us digitally, we have the capability and technology to make it easier for us to connect with you. Is it time to discuss...

Learn how to manage your Financial Stress As a Financial Advisor, we often have clients come to see us without their spouses, for investment or financial planning session. But then, there's also many that never visit without their other half. So, having problems...

Getting ahead in your 40's? Here’s 5 tips you need to consider to getting ahead in your 40's.. Being in your 40s requires balancing many responsibilities and it can become easy to neglect your own financial wellbeing. However, it’s not too late to secure your future. ...

Occurring in 99 per cent of domestic violence cases, economic abuse can affect clients of all backgrounds

Standards International has partnered with Australian adviser Amanda Cassar to launch a new training programme aimed at tackling economic abuse.

Economic abuse is when one person has control over another’s access to economic resources. It was recognised as a form of domestic abuse in the domestic abuse bill last year after calls from charities to make it a standalone criminal offence.

RECENT POSTS

CATEGORIES

P.O Box 3592, Burleigh Town, QLD, 4220

Phone: 07 5593 0855

Email: info@wealthplanningpartners.com.au

9am - 5pm Monday to Thursday

9am - 12pm Friday

(Other appointment times by request)

WPP Licensee Services Pty Ltd

P.O Box 3592, Burleigh Town, QLD, 4220

Robina, QLD, 4226

AFSL No. 530393

ABN# 76 649 079 998

Copyright © 2023 Wealth Planning Partners Pty Ltd | All Rights Reserved | Website designed by Xenex Media

Notifications