If you’re a recent retiree and looking to increase superannuation savings, we’ve got some good news!

The Australian Government is proposing to make it easier to boost super with the work test exemption. For recent retirees, you can save more super by contributing for a year without having to show you’ve been ‘gainfully employed’.

Current rules

Currently, anyone under age 65 can contribute to their super regardless of whether they work or not. But, those aged between 65 and 74 need to meet the ‘work test‘ before they can make super contributions. To pass, they have to show they’ve been gainfully employed for at least 40 hours over 30 consecutive days in the financial year they plan to contribute.

The government has already given members with a total super balance of less than $500,000 some flexibility to grow super. These individuals can carry forward any unused amount below the concessional contribution cap of $25,000. This can occur on a rolling basis for 5 years from 1 July 2018. They can use unused cap amounts from 1 July 2019. People between 65 and 74 must still meet the work test before they can make ‘catch‑up’ contributions.

Proposed measure

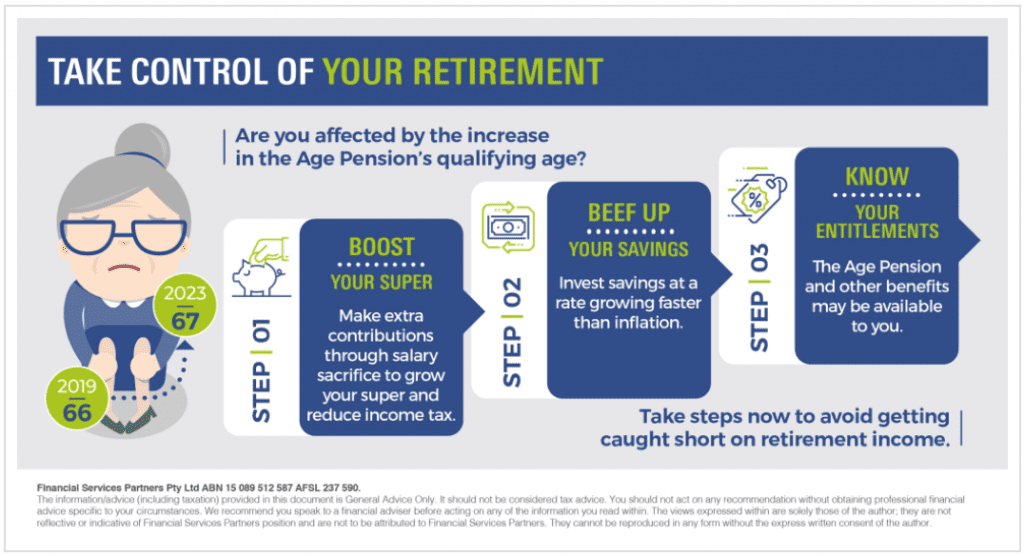

So, to encourage this age group to save even more for retirement, the government is proposing changes. This is to give individuals who don’t meet the work test an extra year to beef up super savings.

From 1 July 2019, those between 65 and 74 with a super balance under $300,000 will be able to make voluntary contributions. This is in the first financial year that they don’t satisfy the work test. Once eligible, they don’t have to remain under the $300,000 balance cap during the 12‑month period.

The annual concessional and non-concessional contributions caps will continue to apply, but members can access unused concessional contributions cap amounts they have carried forward.

The government will assess total super balances at 30 June of the financial year in which members last met the work test. So those who retire in the 2018–19 financial year may be eligible to make additional contributions.

Seek professional advice

If you’re considering contributing to your super under the proposed work test exemption, it may be wise to speak to your adviser to see how making additional super contributions may work to your advantage. We’re your local Gold Coast financial advisers. So give us a call to see if this applies to you! 07 5593 0855.

February 14, 2024

February 14, 2024