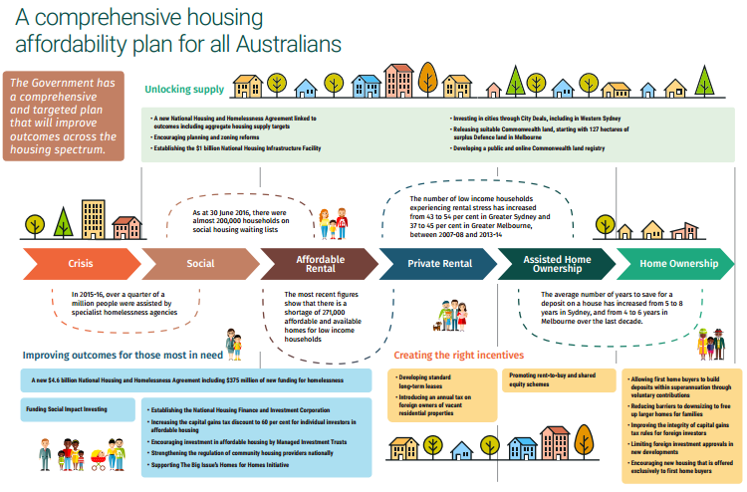

The Government has announced some Incentives to improve housing options. Among these, are:

- Allowing first-home buyers to save a deposit through voluntary contributions to superannuation

- Disallowing travel deductions for investment residential property

- Limiting depreciation deductions for plant and equipment on residential investment properties

- Tightening the capital gains tax rules for foreign investors

- Reforming foreign investment rules to discourage investors from leaving properties vacant.

First-home buyers can use super

- First-home buyers will be able to use voluntary contributions to their existing superannuationfunds to save for a house deposit.

- Contributions and earnings will be taxed at 15 per cent, rather than marginal rates, and withdrawals will be taxed at their marginal rate, less 30 basis points. Contributions will be limited to $30,000 per person in total and $15,000 per year.

- Both members of a couple can take advantage of the scheme.

- Non-concessional contributions can also be made but will not benefit from the tax concessions apart from earnings being taxed at 15%.

First-home deposit salary sacrifice case study

Louise earns $60,000 a year and wants to buy her first home. She directs $10,000 of pre-tax income into her superannuation account using salary sacrifice, increasing her balance by $8,500 after the contributions tax has been paid by her fund. After three years, she is able to withdraw $27,380 of contributions and the deemed earnings.

After withdrawal tax, she has $25,760 she can use for her deposit. Louise has saved about $6,240 more for a deposit than if she had saved in a standard deposit account. Louise’s partner, Craig, makes the same income and salary sacrifices $10,000 over the same period. Together, after three years, they have $51,520 for their first home, $12,480 more than if they had saved in a standard deposit account. (Source: 2017 Budget papers)

Unlocking supply

- The Government will help boost housing supply by:

- Providing $1 billion facility for critical infrastructure, such as water supplies

- Working with the States on planning and zoning reform to speed up development

- Releasing suitable Commonwealth land, starting with Defence land at Maribyrnong in Melbourne

- Investing more than $70 billion from 2013 to 2021 on transport infrastructure

- Specifying housing supply targets in new agreements with the States and Territories.

January 18, 2025

January 18, 2025