When you donate to charity, your gifts may be a tax deductible donation that can boost your tax refund.

There are many charities in Australia that rely on donations to continue their good work and nine out of 10 of us give to charity each year*. Here we provide a guide to making your gift go further and claiming your donation back at tax time.

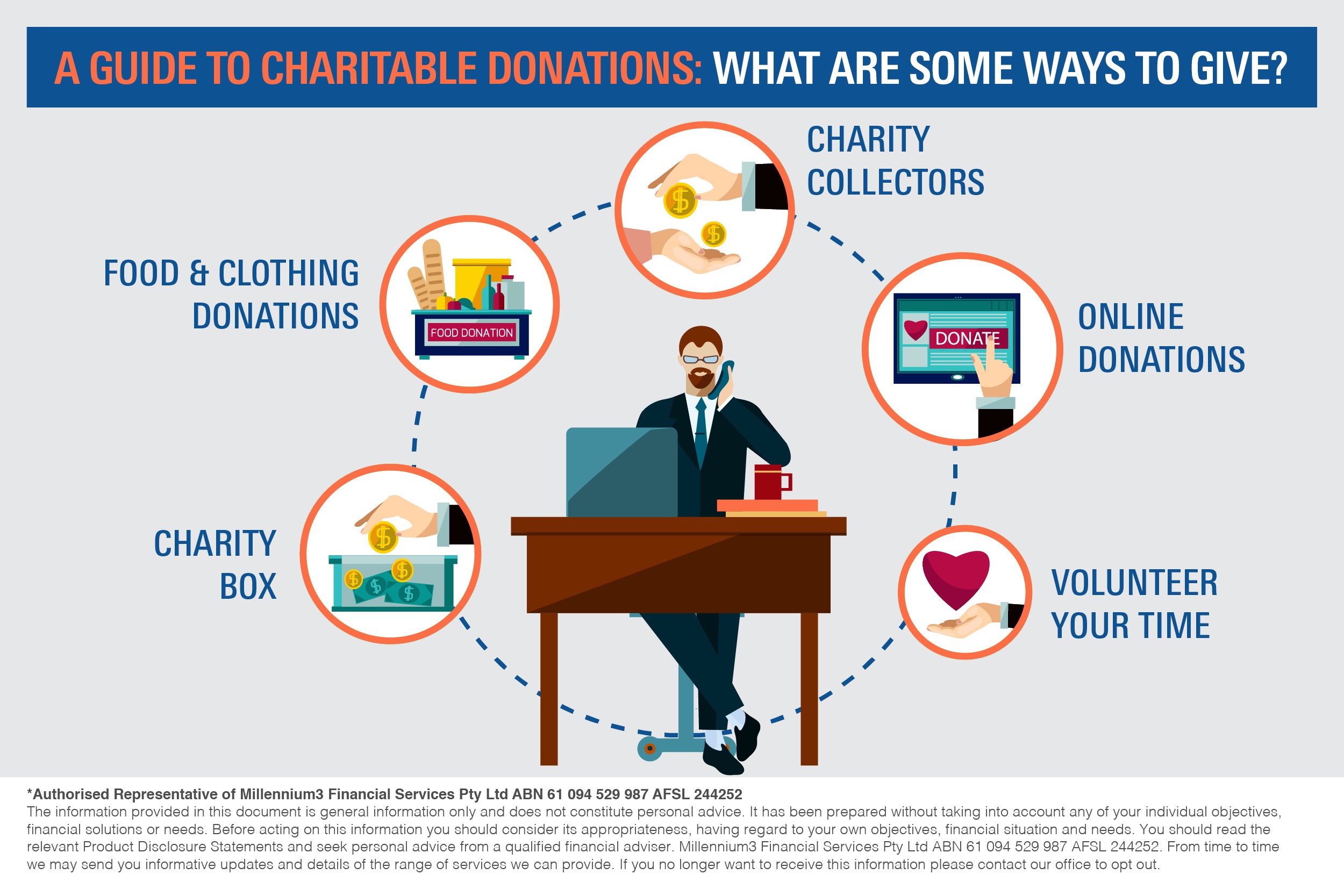

What are some ways to give?

According to consumer group Choice, some great ways to give to charity are to give directly or to volunteer. More than 30% of Australia’s adult population volunteer with various not-for-profit organisations, giving an average of 56 hours per year. If you are interested in volunteering some of your time, visit the Go Volunteer website to find out about opportunities in your area.

Less effective ways to give are charity dinners and balls, as the cost of the venue and catering can eat into your donation. Charity telemarketers also take a cut of the money you give.

Tips for claiming charitable donations

Charitable donations are generally tax-deductible but before claiming any donations on your tax return, here are a few tips:

- The charity must be classified as a deductible gift recipient (DGR). To check, visit the Australian Business Register.

- To qualify for a tax refund, your gift must be greater than $2. Keep receipts for any donations you make.

- The gift must truly be a gift – a voluntary transfer of money where you receive no benefit or advantage. You cannot claim items such as raffle tickets; items such as pens or chocolate

or membership fees.

Two favourite charities that Wealth Planning Partners are proud to support financially, and with our time, are The Hunger Project, who aim to eradicate chronic, persistent hunger by 2030 and Hands Across the Water, helping orphaned and disadvantaged children in Thailand.

*Charity donations guide, Choice, September 2014

January 18, 2025

January 18, 2025