Are you a Mature Australian? Or would at least like to think so? Wondering how the budget changes will affect you – or those other Mature Australians around you?

Here’s a quick wrap of the main alterations that may impact you from Budget 2014:

- The Super Guarantee levy has been pushed back by one year. It will increase to 9.5% on 1 July 2014 and then be frozen until 1 July 2018. Previously, the levy was to reach 12% by 1 July 2019 under Labor proposals, 1 July 2021 under the Coalition promise, now 1 July 2022.

- Excess non-concessional contributions – excess contributions tax eliminated (positive) – now refunded, any earnings taxed at marginal rate.

- Increase in caps (positive) – concessional $30,000, non-concessional $180,000.

- Australian Defence Force Super – new recruits from 1 July 2016 end of defined benefit.

A couple of other Tax Changes:

- The Mature Age Tax Offset abolished from 1 July 2014 (previously restricted).

- Dependent Spouse Tax Offset abolished from 1 July 2014 (previously restricted).

Changes to the Pension include:

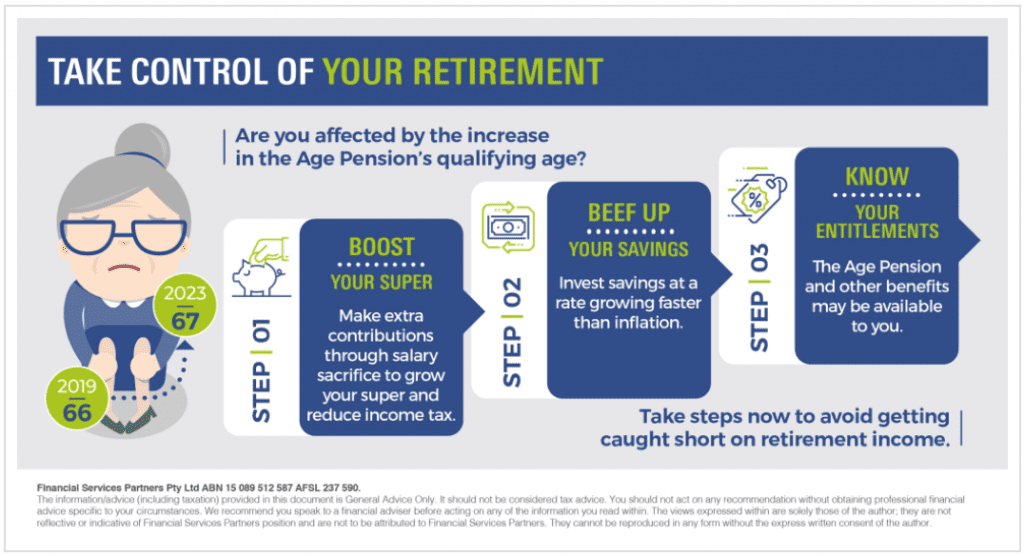

- The pension age will rise to 70 by 2035.

- Indexation by CPI (rather than average male OTE) from September 2017.

- Indexation of asset test/income test thresholds frozen for three years from 2017.

- Deeming rates (for income test) reset to $30,000/$50,000 from 2017 (currently $46,600/$77,400).

Updates to the Commonwealth Seniors Health Card will be:

- Superannuation balances are to be counted in the income test (presumably at the deeming rate) – which makes it harder for non-pensioners to qualify (income limits currently $50.000/$80,000).

- No Seniors supplement – abolished from 1/7/14 ($876.20 for single, $1,320.80 couple).

It’s been a tough budget, but perhaps not as tough as some were expecting. All Australians have been told to bear the burden. According to Federal Treasurer Joe Hockey, “the economy is growing at less than normal speed and the time to fix the budget is now.”

February 14, 2024

February 14, 2024